Don’t worry. I’m not talking about getting the sack! FIRE is an acronym for “Financial Independence Retire Early”. The FIRE movement has caught traction over recent years, enabling many people to retire young and live financially free.

Disclaimer: The information in this blog is my personal opinion and experience and is not legal or financial advice in any way! Also, just FYI, this post may contain affiliate links.

Hardcore FIRE movement adopters live a frugal lifestyle and save up to 70% of their salary. Their aim is to invest intensively so that they can be financially independent and retire early.

By adopting this, some people manage to retire in just 4 years.

Here’s how they do it.

Choose your Retirement Age

It was a real revelation for me when I realised that it is within my power to decide what age I want to retire.

I had always thought that retirement age was dictated by the government (68 years old for women in the UK).

But that is just the age you’re entitled to a state pension in the UK – it’s not the age you have to retire.

(Besides, who knows if state pension will even be a thing by the time we retire!?)

You can decide what age you want to retire.

However, most people target the state-dictated retirement age because that is when we expect to have enough money to do so.

But what if we could become financially free much sooner?

Imagine working, not for the money, but purely for the enjoyment of doing it.

With the right focus, it’s within your power to turn that into a reality.

You simply have to:

- decide your chosen retirement age; and

- work backwards to plan how much you need to save between now and then to achieve your savings target.

For example, the age by which I aim to become financially free is 34. At the time of writing this, I’m 30 years old. So that gives me 4 years to build my savings pot.

Challenge accepted!

Adopt the 4% Rule

In the FIRE community, the 4% rule is key.

The 4% rule essentially means that you invest in low cost index funds and then live by the rule of only withdrawing a maximum of 4% from your investment pot each year.

Why 4%?

According to the FIRE’d community, this is the sweet spot because most index funds compound (i.e. grow) at 7% annually.

So if you live off 4%, your investment will keep growing and you’ll have taken account of inflation.

This ensures that you won’t touch your principle capital. So it’ll keep providing your yearly income.

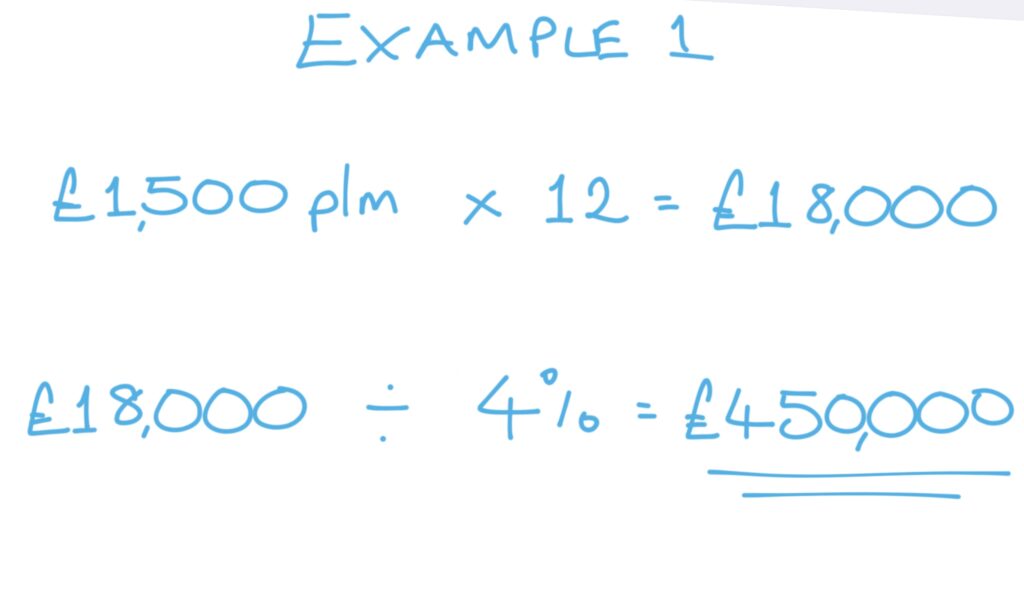

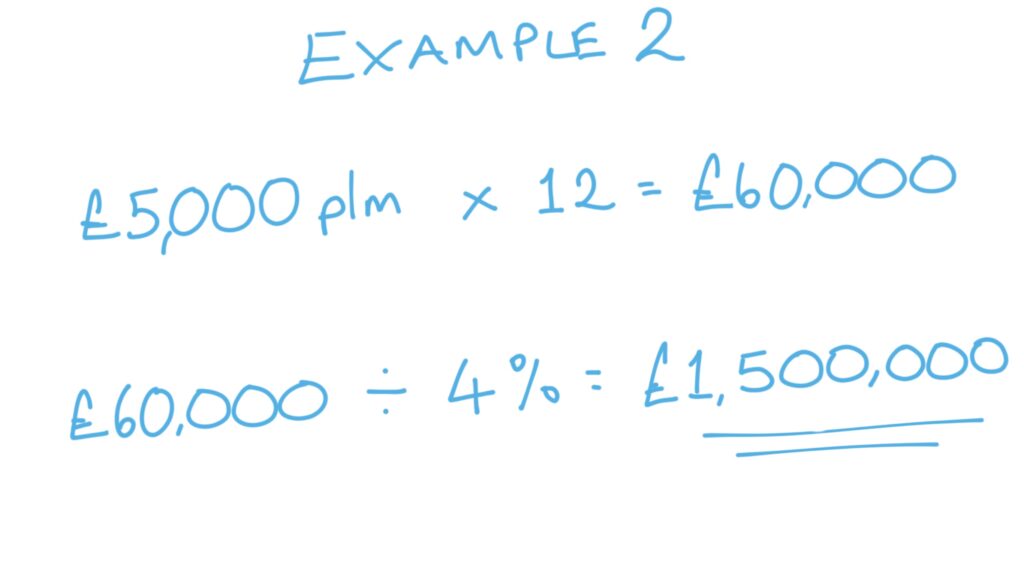

Calculate how much you should save for the 4% rule to work

How much would you need in your bank in order to retire tomorrow?

The average person would probably answer this question by throwing out a number – finger in the air – between £1 million and £10 million.

But for those of us who are more financially literate, there’s a more tried-and-tested calculation:

- calculate how much money spend monthly;

- multiply this by 12 to get your annual spend (be sure to factor in future plans like having kids and add that to your annual spend); then

- divide your annual expenses by 4%.

That would give you the principal amount that you need to save and invest in a compounding asset so that you could live according to the 4% rule.

Don’t be put off by a massive number!

Yes, it probably is a massive number. But don’t be intimidated if your savings target is huge.

Every journey has a starting point.

Be comforted by the fact that many people on normal salaries manage to achieve financial freedom in 5-10 years using this method. So it can be done.

Break it down step by step and remember this is a journey that may take several years.

Compounding will also help you along the way.

Compounding makes your money grow even if you don’t add anything to it. Essentially giving you free money (which is why Einstein described compounding as the 8th wonder of the world)!

Make a Start

Be brave enough to dive in and get started even if you don’t think you’re ready.

It is natural to procrastinate when you’re making a big life change. There is always another book to read or course you can take before you begin (trust me, I know)!

But for every day your money isn’t compounding you’re losing wealth and increasing the years it’ll take to reach financial independence.

Here are some examples of the changes you can make (some more extreme than others!).

Make a big change

The best way to optimize spending is to cut back on housing, transport and food costs. These are the biggest costs for most households.

A few years in a cheaper home, driving a cheaper car and cooking at home more could help you save and invest much, much more.

Better yet, a few years living in another country where salaries are higher could give your savings a significant boost.

You should also always make sure you get paid the salary you deserve and invest your bonus.

Make a small change

Chances are you make small comfort purchases everyday: coffee, snacks, small treats etc.

Whilst they do sometimes inject a little joy into a stressful day, they do add up! And eat into your savings.

On this journey you have to change the way you value what you purchase.

Curb the wasteful spending, make a budget and stick to it.

Stop buying “stuff”

Fancy homes, flash cars and designer handbags are societal status symbols that are seen to represent career success.

But a secure financial future isn’t dependent on how much you earn, it’s dependent on how much you save.

Cut back spending on unnecessary items and only invest in assets that put money in your pocket.

Before you make a big purchase, think about how much you’ll be losing on compound interest by spending that money!

Work on multiple income streams

Most female lawyers only have one income stream: their salary.

Find ways to diversify your income. Consider investing in rental property or creating a side business to maximise your income.

Conclusion

The FIRE movement is defined by frugality, savings and investment. Adopters aim retire young by:

- deciding on their retirement age;

- calculating how much they need to save;

- investing all savings in low cost index funds; and

- withdrawing a maximum of 4% investment pot each year to live on.

If the idea of finding financial freedom in the near future appeals to you, get started and set yourself a goal.

Staying focused on your goal might mean saying no to lots of people (or to a lot of treats). But sacrificing those expensive weekends or shopping trips for a few years might save you decades of free time in the future.

So keep your eye on the prize. It’ll buy you freedom.

3 Responses

[…] I was spending about £30 per month on books in the early days. That’s a lot to spend when you’re trying to budget and live a more frugal lifestyle. […]

[…] For more on this, read How to Create a Budget – and Stick to it and How to Get Yourself FIRE’d. […]

[…] than modest retirement fund. Set a retirement goal by envisaging the life you want. Then write down what age you want to retire and calculate exactly how much income you’ll need to live free from any money […]