Financial freedom is a term that we often come across. But what does it really mean? And what are the different levels of financial freedom?

Disclaimer: The information in this blog is my personal opinion and experience and is not legal or financial advice in any way! Also, just FYI, this post may contain affiliate links.

What is the definition of financial freedom?

Financial freedom is a term that we often come across. You’ll often read different definitions in different books. These definitions include the following:

“Financial freedom is when you have enough passive income to cover your outgoings“

“Financial freedom is when your income generating assets cover all of your liabilities now and in the future“

“Financial freedom is about being able to buy what you want whenever you want whilst supporting yourself and others“

“Financial freedom is the 21st century term for early retirement“

None of these definitions are wrong. It is for you to decide which resonates with you and which level of financial freedom you desire.

But first, let’s break these definitions down.

What are “income generating assets”?

Assets are things that you own that put more money in your pocket on a regular basis. These regular payments are what is known as passive income.

An example of an income generating asset is a rental property: the property is the asset and the rent is the income.

Another example of an income generating asset is an index fund or exchange traded fund (ETF). The ETF is the asset and dividends payout is the income.

What is “passive income”?

Passive income is money that you earn with little or no effort required.

When income is passive, you are not exchanging time for money as you would in a normal job.

Using the rental property example, the rent payments are a form of passive income because you don’t have to do much to get paid.

Using the ETF example, the dividend payments are a form of passive income because you don’t have to do anything to get paid.

What are “liabilities”?

Liabilities are things that take money out of your pocket.

Things like credit card payments, car payments and personal rental and mortgage payments are examples of liabilities.

These are essentially debts that you need to pay.

What are “expenses”?

Similar to liabilities, these are things that cost you money.

Things like utility bills, school fees and food are all expenses.

These are essentially living costs that you need to pay.

What are the different levels of financial freedom?

I believe there are 4 different levels of financial freedom. It is up to you to decide which level you wish to aim for.

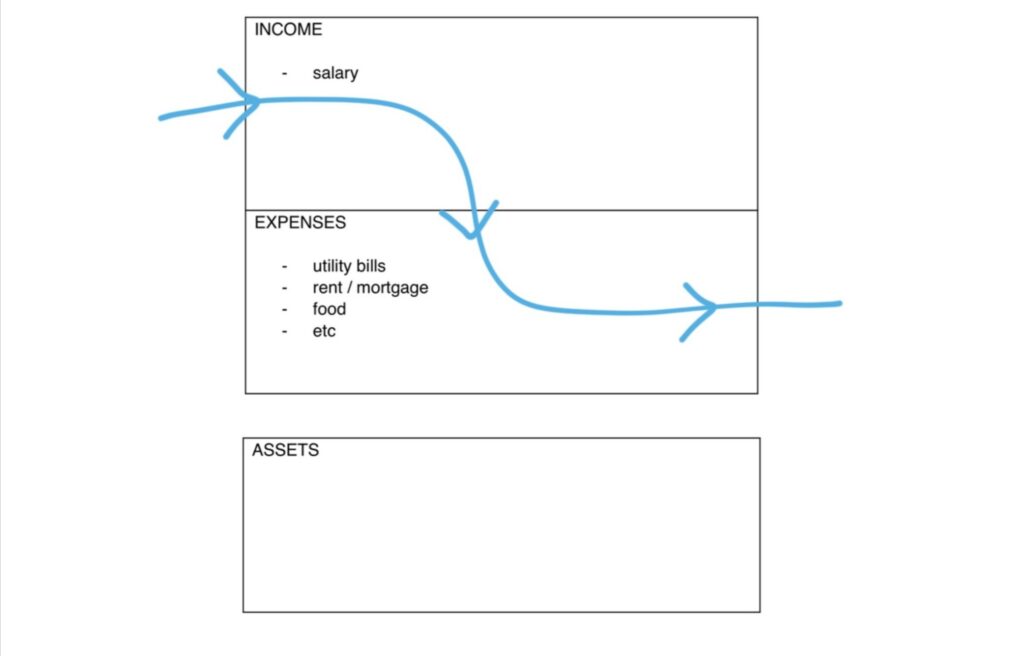

Level 1: No freedom and wholly dependent on a salary

At this stage:

- you have only one stream of income: your salary

- you have little savings

- you rely on your salary to pay the bills

- you would struggle to make ends meet if you lost your job

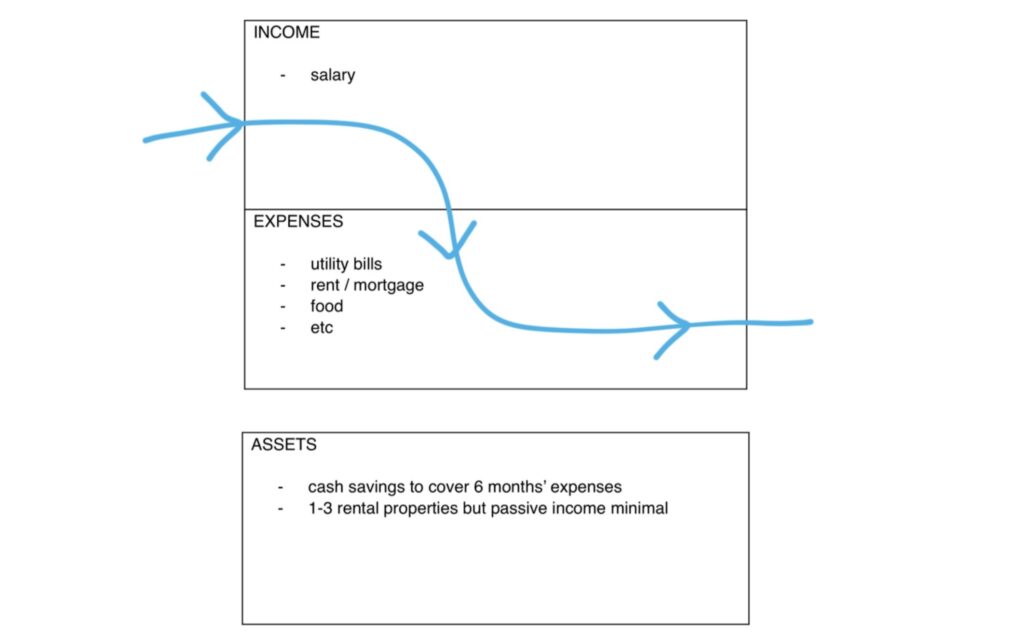

Level 2: Temporary freedom

At this stage:

- you might have a small amount of passive income (e.g. from a rental property) but your salary is your main income

- you have a good size emergency fund of 6 months’ expenses

- you still rely on your salary to pay the bills

- you would feel comfortable switching jobs or taking a career break but wouldn’t be able to leave work all together

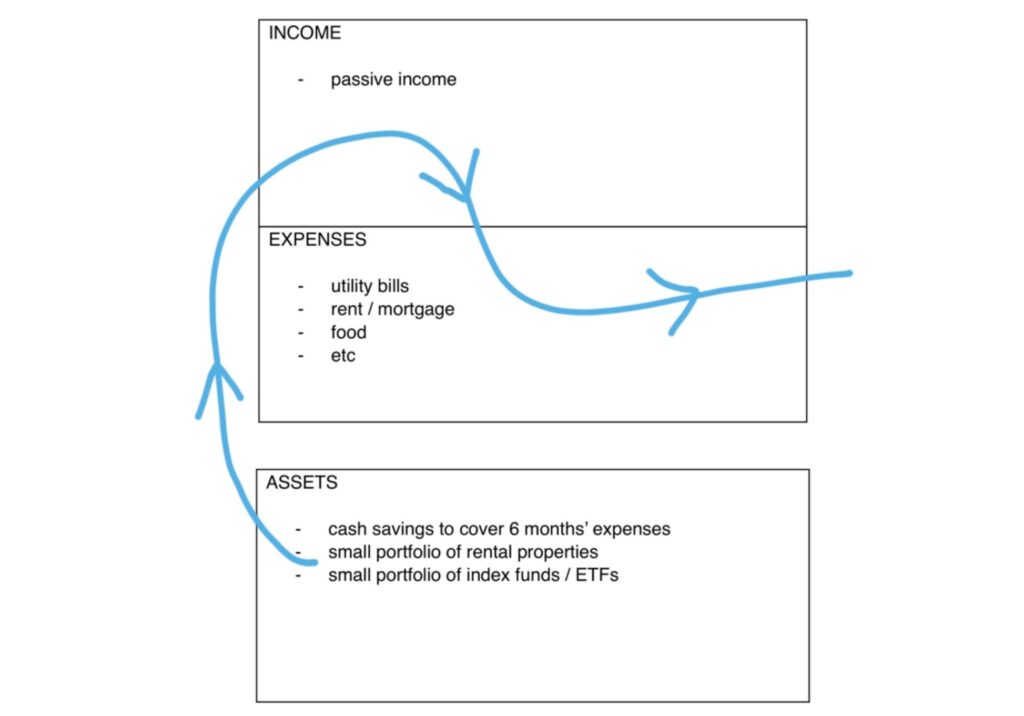

Level 3: Comfortable financial freedom

At this stage :

- your passive income covers your basic expenses

- you have a decent savings pot that keeps growing due to compound interest

- your investment portfolio pays the essential bills

- you could leave your job and live a modest lifestyle if you wanted to

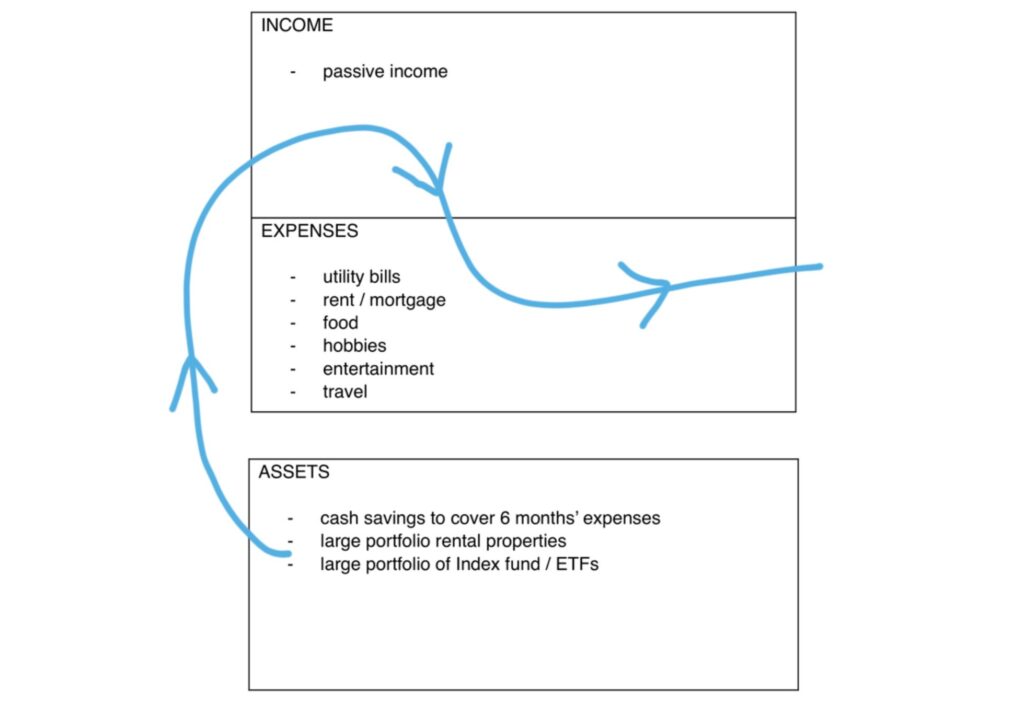

Level 4: Ultimate financial freedom

At this stage:

- your passive income exceeds your expenses and also pays for hobbies, entertainment and travel

- you have a significant savings pot that keeps growing due to compound interest

- your investment portfolio pays for bills and luxuries

- you could leave you job and live a luxurious lifestyle if you wanted to

Of course, being financially free does not require that you retire early – but it gives you the option to do so!

How to get started

Every journey has a starting point.

On the path to financial freedom, that starting point is calculating your net worth. This is your reference point telling you how far you need to go to reach your savings target.

Start by looking at your assets i.e. anything you own of monetary value, including cash in the bank.

Then calculate liabilities i.e. anything you owe, including student loan and mortgages.

Then subtract liabilities from assets.

Don’t panic if your net worth is a negative number. Factor in your deficit by adding it to your savings target.

Conclusion

So, in a nutshell, financial freedom is when you have enough passive income from income generating assets to cover your outgoings.

There are different levels of financial freedom – it is up to you to decide which level to aim for!

3 Responses

[…] the difference between liabilities (things that take money out of your pocket) and assets (things that generate an […]

[…] what your financial goals are: specifically how much do you want, by when and for what. Decide what level of financial freedom you want to aim for. This will inform your investment strategy (which we will come to […]

[…] Wealth isn’t about how much you spend, it’s about how much you keep. Start by understanding the difference between liabilities (things that take money out of your pocket) and assets (things that generate an […]